All about Clark Wealth Partners

Table of ContentsWhat Does Clark Wealth Partners Do?Clark Wealth Partners - An OverviewNot known Facts About Clark Wealth PartnersSee This Report on Clark Wealth PartnersHow Clark Wealth Partners can Save You Time, Stress, and Money.Clark Wealth Partners for DummiesSome Known Questions About Clark Wealth Partners.

The globe of money is a complex one., for instance, just recently located that almost two-thirds of Americans were not able to pass a fundamental, five-question financial proficiency test that quizzed individuals on subjects such as passion, financial debt, and other reasonably fundamental concepts.Along with managing their existing customers, financial consultants will typically invest a reasonable amount of time every week meeting with prospective customers and marketing their services to maintain and expand their organization. For those considering coming to be a monetary expert, it is very important to take into consideration the ordinary salary and work stability for those functioning in the area.

Training courses in tax obligations, estate preparation, investments, and risk monitoring can be handy for pupils on this course. Depending upon your special occupation objectives, you might also require to gain particular licenses to satisfy certain customers' requirements, such as dealing stocks, bonds, and insurance coverage. It can likewise be practical to gain a certification such as a Certified Financial Planner (CFP), Chartered Financial Expert (CFA), or Personal Financial Professional (PFS).

The Definitive Guide for Clark Wealth Partners

Many people choose to obtain help by utilizing the solutions of a monetary specialist. What that looks like can be a number of points, and can vary depending upon your age and phase of life. Prior to you do anything, study is essential. Some people stress that they require a certain amount of money to spend prior to they can get assist from a professional.

The smart Trick of Clark Wealth Partners That Nobody is Talking About

If you have not had any kind of experience with a monetary expert, here's what to anticipate: They'll start by providing a detailed analysis of where you stand with your properties, liabilities and whether you're fulfilling criteria contrasted to your peers for savings and retired life. They'll examine brief- and long-lasting goals. What's valuable regarding this step is that it is individualized for you.

You're young and functioning complete time, have a cars and truck or two and there are student fundings to pay off.

About Clark Wealth Partners

After that you can go over the next best time for follow-up. Before you begin, inquire about pricing. Financial consultants generally have various tiers of prices. Some have minimum asset levels and will bill a fee typically several thousand dollars for producing and readjusting a strategy, or they might charge a level fee.

Always read the small print, and see to it your financial consultant complies with fiduciary standards. You're looking in advance to your retired life and helping your youngsters with college costs. A financial consultant can supply suggestions for those situations and even more. A lot of retirement strategies supply a set-it, forget-it choice that designates possessions based upon your life phase.

The Main Principles Of Clark Wealth Partners

Arrange normal check-ins with your coordinator to modify your strategy as needed. Stabilizing financial savings for retired life and university prices for your children can be difficult.

Considering when you can retire and what post-retirement years may look like can produce worries about whether your retirement financial savings remain in line with your post-work plans, or if you have saved enough to leave a legacy. Assist your economic specialist understand your strategy to cash. If you are extra conservative with saving (and potential loss), their ideas should reply to your worries and concerns.

The Ultimate Guide To Clark Wealth Partners

Intending for health and wellness treatment is one of the huge unknowns in retired life, and an economic expert can lay out alternatives and suggest whether additional insurance policy as protection might be valuable. Before you begin, try to obtain comfy with the idea of sharing your whole financial picture with an expert.

Giving your professional a complete picture can aid them create a plan that's prioritized to all parts of your economic standing, especially as you're quick approaching your post-work years. If your funds are simple and you have a love for doing it on your own, you might be fine on your very own.

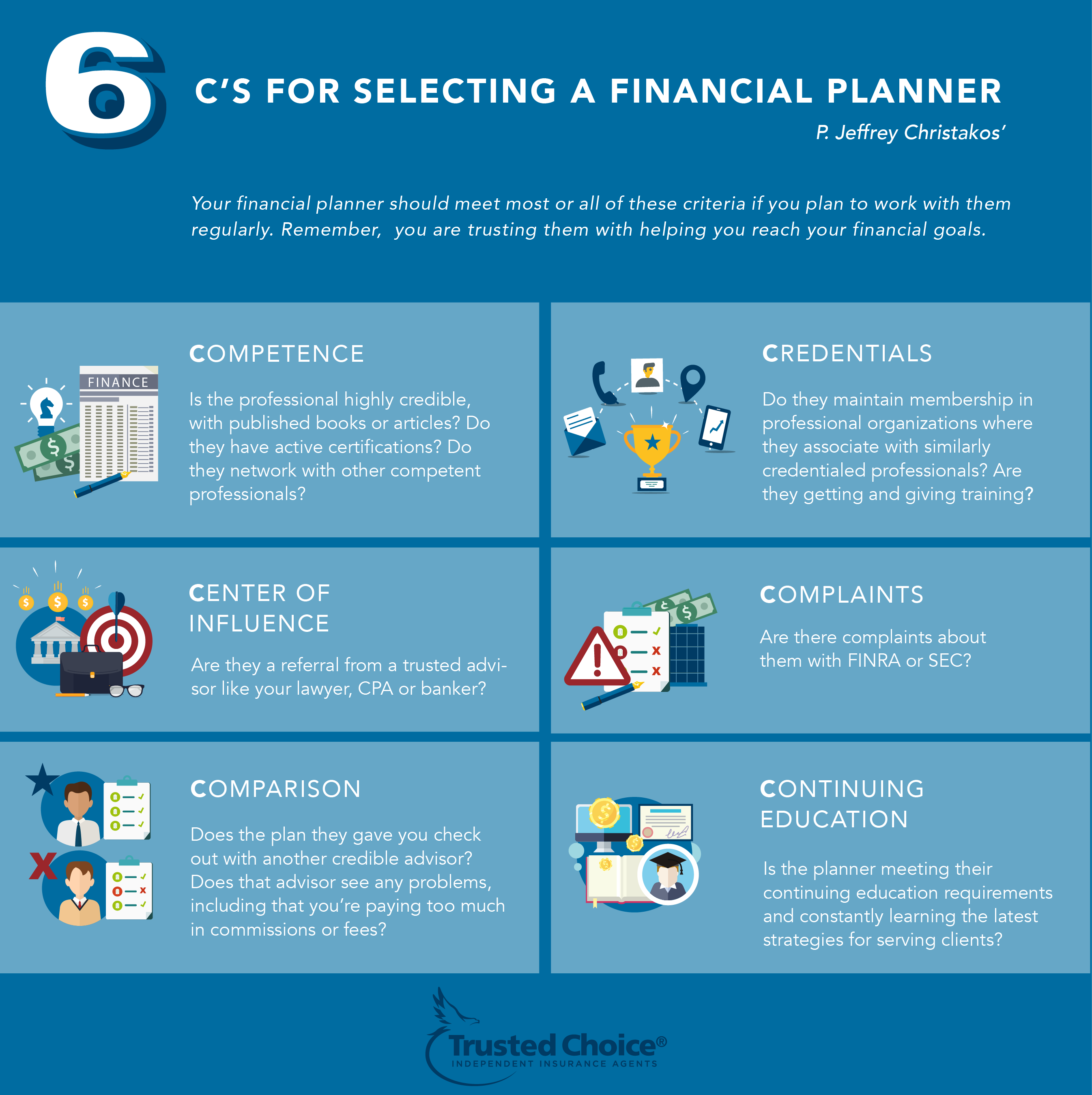

An economic expert is not just for the super-rich; any individual facing major life shifts, nearing retirement, or sensation overwhelmed by monetary decisions could benefit from professional advice. This article discovers the function of financial advisors, when you may require to consult one, and crucial factors to consider for choosing - https://linktr.ee/clrkwlthprtnr. A financial consultant is a skilled expert who aids clients manage their finances and make informed decisions that line up with their life objectives

Clark Wealth Partners Things To Know Before You Buy

Payment models likewise vary. Fee-only consultants charge a level fee, per hour price, or a portion of possessions under administration, which often tends to decrease potential disputes of interest. In contrast, commission-based consultants gain earnings via the financial items they offer, which may influence their recommendations. Whether it is marriage, divorce, the birth of a youngster, occupation changes, or the loss of an enjoyed one, these events have distinct economic ramifications, usually calling for prompt choices that can have long-term effects.